How I organize my personal finances as a financially responsible corporate gal & business owner 💰

a juicy post 👀 & tips on money management so you can focus on what matters

School often teaches us how to get a job, but we rarely learn how to manage the money we make.

I’ve been in the corporate world for around three years now while running a content business on the side, so figuring out how to stay organized and on top of my money game is extremely important to me. Understanding how to manage and optimize my finances was hard at first, but you get the hang of it after creating a sustainable system that works for you. I’m sharing how I approach my organizing my financial life so this can give you some inspiration and tools for how you can too! Disclaimer: this is just my approach and is for informational purposes only (not financial advice)

My next post will be a cover reveal and the story behind my first traditionally published book about financial literacy in the Gen Z space, so if you aren’t already, subscribe so you don’t miss it! 📚🥳

Direct deposits/paychecks

From corporate/my 9-5:

I set a percentage of my salary to automatically go into my 401k account sponsored by work, with the goal of maxing it out each year (the federal limit for 2025 is $23,500). Most companies have retirement plans for full-time employees, and many will even match a percentage of your salary. Highly recommend it since it’s basically free money, and you get to lower your taxable income for the year.

I also spread my salary to pay into my Health Savings Account (HSA), which is a triple tax-advantaged account where you can use towards medical expenses, and invest the funds if you’re not using everything. The 2025 contribution limit is $4,300. Some companies will even provide matches on this account, but it does require you to be enrolled in a high-deductible health plan.

Since at this point I’m pretty familiar with my fixed monthly costs, I keep just enough money in my checking account to cover 1 month’s costs and not more than that.

I transfer a portion out to my high-yield savings account, which is a great place to build your emergency fund or save for short- to medium-term goals. This is better than leaving your money in a traditional checking or savings account because you get some interest (which also feels like free money). I personally use Marcus but I also recommend SoFi!**

From my business (this could apply to anyone who does side stuff or freelances):

I have a separate business bank account for business revenue so it doesn’t get mixed with my personal stuff. I created an LLC for the business once I saw consistent monthly revenue for a couple months, and this is when you can apply for a business checking account and credit card.

I also contribute to a retirement account for business owners, one of the options being a Solo 401k.

I’m a big supporter of creating a small business if you have the time and/or have ideas you want to pursue! As a business owner, you can also “write off” expenses that you use for your business, like softwares, equipment (phone, laptop, etc), business meals, and a lot more.

In short, my process is to keep enough money in my checking account for relevant expenses, allocate my salary to tax-advantaged accounts, leave enough money in my HYSA for an emergency fund (and some extra for medium-term goals), and invest the rest in my taxable brokerage.

What’s in my wallet 💳

I started getting into credit cards to build my credit score when I was 18 in college (and to play the points game lol). I always pay off my credit card statement off in full, every month.

My current credit card stack consists of (none of this is sponsored–I use these cards!):

Chase Freedom Unlimited (beginner card): This was one of my first credit cards that I got back in college! No annual fee and pretty solid card. 1.5% cash back on all purchases!

Chase Sapphire Preferred (intermediate card): This was my first “premium” card, and it’s the first upgrade after the Freedom in the “Chase trifecta.” The annual fee is $95 and you can earn 75,000 bonus points after spending $5,000 in the first 3 months. The rewards you get per purchase is a substantial improvement from the Freedom Unlimited. This is a good entry travel card because this one allows you to transfer “points” to various airlines to redeem for travel (which you can’t do on the Freedom Unlimited).

Capital One Venture X (advanced card): This is a travel credit card with an annual fee of $395, so if you travel a few times a year, the benefits outweigh the annual cost. My favorite benefit is the $300 travel credit that lets you book towards flights and hotels! I applied to credit cards like these when I know I’m saving up to buy a few bigger items, as the current offer is 75,000 bonus miles when you spend $4,000 within the first three months.

Chase Ink Business Unlimited: I use this card only for business expenses (and try to keep personal expenses separate). It’s a pretty run-of-the-mill card. The benefits are similar to the Freedom Unlimited, and it’s good for those starting out in a new business venture.

One thing to note–some of these credit cards require you to spend a decent amount of money in order to get the one-time bonus. I wouldn’t recommend the paid cards unless you know you have big purchases coming up and have good credit card habits. They might not be as useful if you don’t travel at least once a year since some of the benefits are tied to traveling.

Investments 📊

I invest mainly in public equities across my 401k, Roth IRA, Solo 401k, and regular brokerage. Here’s my approximate breakdown:

70% in index funds and ETFs: My biggest holding is VTI, which tracks the overall US stock market. Some honorable mentions include VOO, QQQ, and SCHG.

20% in my company’s stock: My company provides RSUs (restricted stock units) every month as part of compensation. So far, I haven’t sold anything from this pool and it’s up around 20%. I’m definitely more bullish on tech but I’ll likely diversify some of this in the near future.

10% stock picking: This is definitely super risky so a smaller portion of my portfolio is allocated for this. I put some money into NVIDIA a couple of years ago and it’s returned very well, but this is definitely hindsight and picking individual stocks is risky.

I’m a big believer in allocating most funds into ETFs that track the overall market to keep up with the average market returns, as I’m an advocate for holding onto investments for the long term and I don’t plan on taking out most of these investments until my later years (or if I need to sell some stocks for a house downpayment).

Even if you’re just starting out with investing, I highly recommend you start early! When you’re younger, the biggest resource you have is time, and compound interest really kicks in when you start early. I’ve been investing consistently into stocks for the last five years, and currently, over 15% of my net worth comes from stock market gains alone, and it’ll only pick up in growth as more time passes.

Books 💸

Here are some of my favorite personal finance books I’ve read that are beginner-friendly and will help you learn more about how the financial world works:

I Will Teach You To Be Rich by Ramit Sethi

Financial Feminist by Tori Dunlap

The Psychology of Money by Morgan Housel

The Simple Path to Wealth by J L Collins

Rich AF by Vivian Tu

Tracking systems

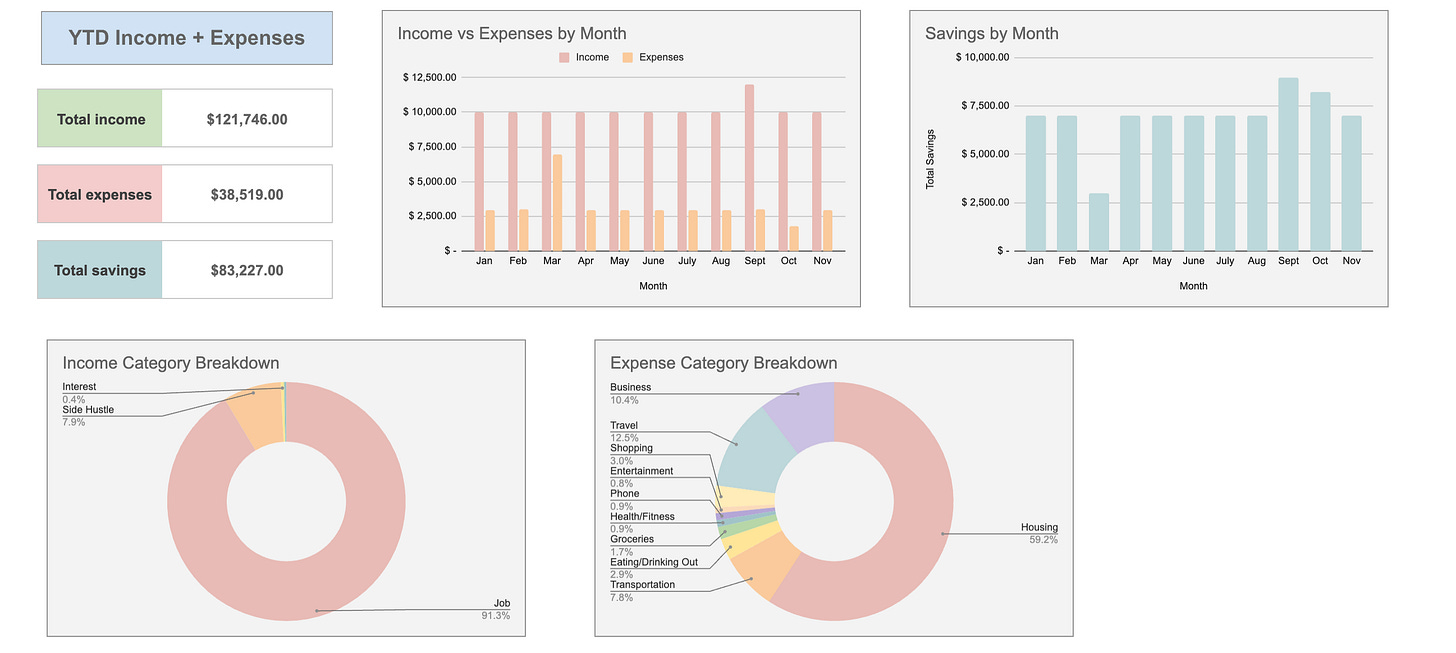

I’ve been a loyal user of Google Sheets for years, and this includes tracking my finances for these key metrics: income, expenses, savings, and net worth. It’s a nonnegotiable for me to track these metrics on a weekly (income & expenses) and monthly (net worth trend). It doesn’t take up a ton of time and by doing this, it helps you keep track of your financial goals, and it’s pretty cool to see the totals and trends when you look back! You can check out the links to the exact spreadsheets I use here.

I hope this helps! If you enjoyed reading, the best compliment I could receive is sharing this post with a friend who’d find it helpful and restacking/resharing this post! And feel free to leave any questions in the comments and I’ll get back to you :-)

xx,

Lillian

Follow me on Instagram and TikTok for more content and updates!

**Note: Some of these links may be affiliate links which are at no cost to you

And energetic work you can do

https://open.substack.com/pub/lisariesner/p/chosen-the-reprogramming-f0d?utm_source=share&utm_medium=android&r=4ei3qu